Cano Health Announces Closing of $150 Million Term Loan Facility with Diameter Capital Partners and Rubicon Founders

Cano Health Announces Closing of $150 Million Term Loan Facility

with Diameter Capital Partners and Rubicon Founders

Announces Preliminary Fourth Quarter 2022 Summary Financial Results

MIAMI, FL February 27, 2023 /PRNewswire/– Cano Health, Inc. (“Cano Health” or the “Company”) (NYSE: CANO), a leading value-based primary care provider and population health company, today announced that on February 24, 2023, it consummated the closing of a $150 million senior secured term loan (the “2023 Term Loan”), maturing November 23, 2027.

Lenders in the 2023 Term Loan were Diameter Capital Partners, Rubicon Founders and their respective affiliates and managed funds.

The 2023 Term Loan bears interest at 14% per annum in the first two years after initial funding, payable quarterly in cash or in-kind as an addition to the principal balance of the 2023 Term Loan, at the Company’s election, and, thereafter, 13% per annum, payable quarterly in cash. The 2023 Term Loan ranks pari passu in right of payment and lien priority with indebtedness under the Company’s existing senior credit facilities.

In connection with the 2023 Term Loan, the Company issued to the lenders warrants to purchase up to approximately 29.5 million shares of the Company’s Class A common stock, or up to 5.5% of pro forma fully diluted shares outstanding, exercisable until February 24, 2028, at an exercise price of $0.01 per share. The Company has agreed to register the shares of Class A common stock underlying the warrants with the U.S. Securities and Exchange Commission (“SEC”).

Cano Health intends to use proceeds from the transaction for general corporate purposes, including the repayment of amounts outstanding under its existing revolving credit facility, and to pay transaction fees and expenses related to the 2023 Term Loan.

“We are pleased to partner with experienced investors like Diameter and Rubicon who recognize the value of our platform,” said Dr. Marlow Hernandez, Chairman and Chief Executive Officer of Cano Health. “With the completion of this financing, we remain focused on optimizing our existing capacity to continue to unlock the embedded profitability within our medical centers. In addition, the Company will continue to review our operations with the objective of further enhancing liquidity, improving margins, and maximizing long-term shareholder value.”

Jonathan Lewinsohn and Scott Goodwin, co-founders and Managing Partners of Diameter Capital Partners, said “As an existing lender to Cano Health, we are pleased to demonstrate our conviction in the Company. Cano Health operates in one of the most exciting areas of healthcare services, and we believe that the current capital infusion will help the Company realize its unique potential.”

“Our partnership with Cano Health meets our mission of advancing value-based primary care for underserved populations. We are pleased to support Cano Health in continuing to fulfill its goals of improving patient health and outcomes in the communities it serves,” said Adam Boehler, Managing Partner of Rubicon Founders.

JPMorgan Chase Bank, N.A. served as sole lead arranger and sole bookrunner in connection with the 2023 Term Loan and Goodwin Procter LLP served as legal advisor to Cano Health in connection with the 2023 Term Loan and warrants.

Preliminary Unaudited Fourth Quarter 2022 Summary Results

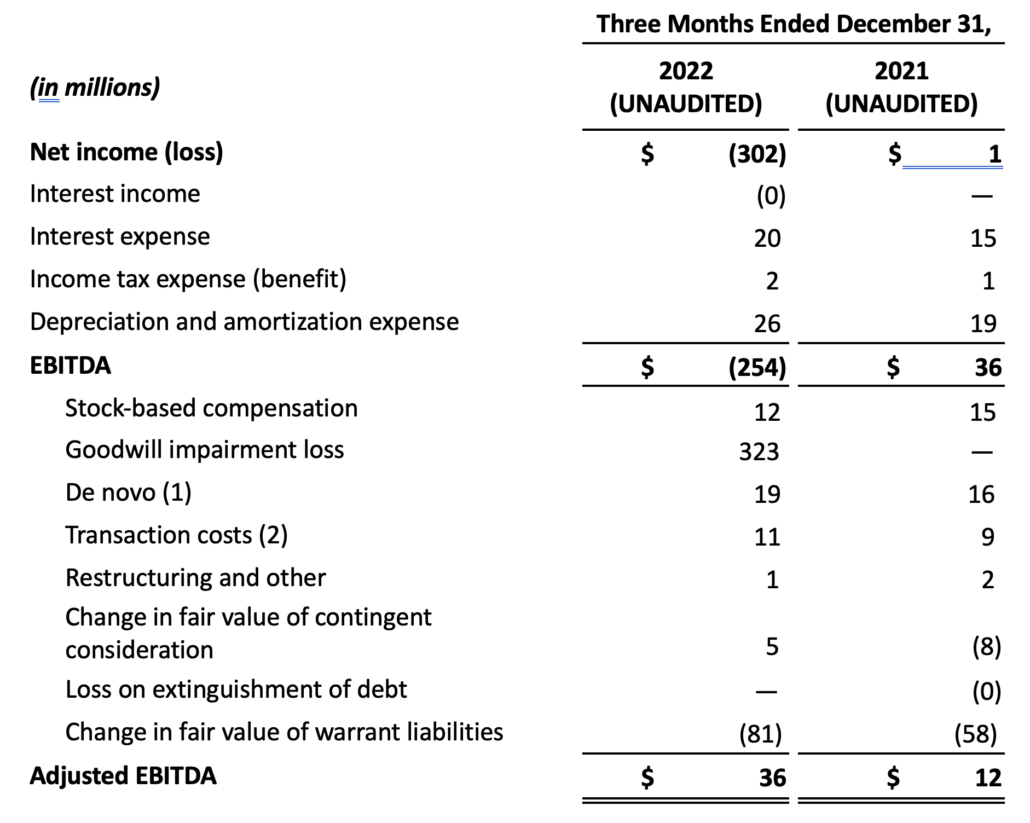

Cano Health today reported membership and preliminary estimated unaudited total revenue, net loss, and Adjusted EBITDA[1] for its fourth quarter ended December 31, 2022.

Total membership at the end of the fourth quarter 2022 is estimated to be approximately 310,000, higher than the previous guidance of 300,000 to 305,000 members. Preliminary unaudited total revenue, net loss, and Adjusted EBITDA for the fourth quarter of 2022 are estimated to be approximately $680 million, $(302) million[2], and $36 million, respectively. Total revenue and Adjusted EBITDA are within the range implied by prior full year guidance.

The Company is scheduled to release its final financial results for the fourth quarter and full year ended December 31, 2022 after the market closes on Wednesday, March 1, 2023, and host a conference call the same day at 5:00 PM Eastern Time to review the Company’s business and financial results.

The Company has not yet completed its quarter and year-end financial close processes for the quarter and year ended December 31, 2022. The preliminary financial results presented herein have not been audited and are based on information currently available to the Company. Accordingly, such results are subject to revision as a result of the Company’s completion of its normal quarter and year-end accounting closing procedures, including customary reviews and approvals, completion by the Company’s independent registered public accounting firm of its audit of such financial statements, asset recoverability accounting analysis, the execution of its internal controls over financial reporting, final adjustments and other developments arising between now and the time that our financial results for the three months and year ended December 31, 2022 are finalized. As such, the Company’s actual results may materially vary from the preliminary results presented in this press release. In addition, the Company’s estimated financial performance for the fourth quarter of 2022 is not a comprehensive statement of the Company’s financial results for the three months ended December 31, 2022, and does not present all information necessary for an understanding of the Company’s financial condition and results of operations as of and for the three months and/or fiscal year ended December 31, 2022.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements relate to future events and involve known and unknown risks, uncertainties and other factors which are, in some cases, beyond our control and could materially affect actual results, performance or achievements. Such forward-looking statement include, without limitation, our anticipated results of operations, including our financial guidance for the 2022 fiscal year, our business strategies, our projected costs, prospects and plans, and other aspects of our operations or

operating results. These forward-looking statements generally can be identified by phrases such as “will,” “expects,” “anticipates,” “foresees,” “forecasts,” “estimates” or other words or phrases of similar import, including, without limitation, the Company’s (i) expectation to use proceeds from the transaction for general corporate purposes, including the repayment of amounts outstanding under its existing revolving credit facility, and to pay transaction fees and expenses related to the 2023 Term Loan, and that this capital infusion will help the Company realize its unique potential; (ii) plans to optimize its existing capacity to continue to unlock embedded profitability within its medical centers; (iii) plans and expectations with respect to continuing to review its operations with the objective of further enhancing liquidity, improving margins, and maximizing long-term shareholder value; and (iv) plans to continue fulfilling its goals of improving patient health and outcomes in the communities it serves. It is uncertain whether any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do, what impact they will have on our results of operations and financial condition. Important risks and uncertainties that could cause our actual results and financial condition to differ materially from those indicated in forward-looking statements include, among others, changes in market or industry conditions, regulatory environment, competitive conditions, and receptivity to our services; changes in our strategy, future operations, prospects and plans; developments and uncertainties related to the Direct Contracting Entity program; our ability to realize expected financial results, including with respect to patient membership, total revenue and earnings; our ability to predict and control our medical cost ratio; our ability to grow market share in existing markets or enter into new markets and continue our growth; our ability to integrate our acquisitions and achieve desired synergies; our ability to maintain our relationships with health plans and other key payors; the impact of COVID-19 on our business and results of operations; our future capital requirements and sources and uses of cash, including funds to satisfy our liquidity needs; and our ability to recruit and retain qualified team members and independent physicians. The Company may also experience delays or difficulties in, and/or unexpected or less than anticipated results from (i) using the proceeds from the 2023 Term Loan transaction for general corporate purposes, repaying amounts outstanding under its existing revolving credit agreement, and/or to pay related transaction fees, such as due to unanticipated demands on its available sources of cash; (ii) its focus on optimizing its existing capacity to continue to unlock embedded profitability within its medical centers, such as due to increased competition in the provision of health care services, increasing costs, tightness in the labor market or less than expected sources of, or access to, liquidity; (iii) its efforts to review its operations with the objective of further enhancing liquidity, improving margins, and maximizing long-term shareholder value, such as due to tightness in the credit or M&A markets, higher interest rates, and/or a higher inflationary environment, which could adversely affect the Company’s ability to improve its liquidity, cash flow and/or long-term shareholder value; and/or (iv) its plans to continue fulfilling its goals of improving patient health and outcomes in the communities it serves, such as due to , such as due to higher than expected medical costs or the spread of other pandemics. For a detailed discussion of the risks and uncertainties that could cause our actual results to differ materially from those expressed or implied by the forward-looking statements, please refer to our filings with the SEC. Factors other than those listed above could also cause the Company’s results to differ materially from expected results. All information provided in this press release is as of the date hereof, and we undertake no duty to update or revise this information unless required by law.

Non-GAAP Financial Measures

This press release contains certain non-GAAP financial measures as defined by the SEC rules. EBITDA and Adjusted EBITDA have not been prepared in accordance with United States generally accepted accounting principles (“GAAP”). EBITDA is defined as net income (loss) before interest, income taxes, depreciation and amortization. Adjusted EBITDA is defined as EBITDA, adjusted to add back the effect of certain expenses, such as stock-based compensation expense, non-cash goodwill impairment loss, de novo losses (consisting of costs associated with the ramp up of new medical centers and losses incurred for the 12 months after the opening of a new facility), transaction costs (consisting of transaction costs and corporate development payroll costs), restructuring and other charges, fair value adjustments in contingent consideration, loss on extinguishment of debt and changes in fair value of warrant liabilities. The Company’s management uses the non-GAAP financial measures as operating performance measures and as an integral part of its reporting and planning processes and to, among other things: (i) monitor and evaluate the performance of the Company’s business operations, financial performance and overall liquidity; (ii) facilitate management’s internal comparisons of the Company’s historical operating performance of its business operations; (iii) facilitate management’s external comparisons of the results of its overall business to the historical operating performance of other companies that may have different capital structures and debt levels; (iv) review and assess the operating performance of the Company’s management team and, together with other operational objectives, as a measure in evaluating employee compensation, including bonuses and other incentive compensation; (v) analyze and evaluate financial and strategic planning decisions regarding future operating investments; and (vi) plan for and prepare future annual operating budgets and determine appropriate levels of operating investments. We believe these non-GAAP financial measures provide an additional tool for our management and investors to use in evaluating our financial condition, ongoing operating performance and trends and in comparing our financial measures with other similar companies. Management believes that the non-GAAP financial measures provide useful information to investors and greater transparency about the performance, from management’s perspective, of the Company’s overall business because such measures eliminate the effects of certain charges that are not directly attributable to the Company’s underlying operating performance. Additionally, management believes that providing the non-GAAP financial measures enhances the comparability for investors in assessing the Company’s financial reporting.

The non-GAAP financial measures should not be considered in isolation or as a substitute for their respective most directly comparable As Reported financial measures prepared in accordance with GAAP, such as net income/loss. These non-GAAP financial measures are subject to inherent limitations as they reflect the exercise of judgments by management about which expense, income and other items are excluded or included in determining these non-GAAP financial measures. In addition, other companies may define such non-GAAP measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of our non-GAAP financial measures as tools for comparison. Also, while EBITDA and Adjusted EBITDA, as used in this release, are defined differently than Adjusted EBITDA for the Company’s credit agreements and indentures, certain financial covenants in its borrowing arrangements are tied to similar financial measures. These non-GAAP financial measures should be read in conjunction with the Company’s financial statements and related footnotes filed with the SEC.

A reconciliation of those measures to their most directly comparable GAAP measures is available under the heading “Reconciliation of Non-GAAP Measures.”

The Company has not reconciled its expectations as to non-GAAP measures in future periods to their most directly comparable GAAP measure because certain costs and expenses are outside of its control or cannot be reasonably predicted. Accordingly, reconciliation is not available without unreasonable effort, although it is important to note that these factors could be material to the Company’s results computed in accordance with GAAP.

Other

This press release does not constitute an offer to sell or the solicitation of an offer to buy any security and shall not constitute an offer, solicitation, or sale of any security in any jurisdiction in which such offering, solicitation or sale would be unlawful.

About Cano Health

Cano Health (NYSE: CANO) is a high-touch, technology-powered healthcare company delivering personalized, value-based primary care to approximately 300,000 members. With its headquarters in Miami, Florida, Cano Health is transforming healthcare by delivering primary care that measurably improves the health, wellness, and quality of life of its patients and the communities it serves. Founded in 2009, Cano Health has more than 4,000 employees, and operates primary care medical centers and supports affiliated providers in nine states and Puerto Rico. For more information, visit canohealth.com or investors.canohealth.com.

([1]) Adjusted EBITDA is a non-GAAP financial measure. A reconciliation of this non-GAAP financial measure to its most directly comparable GAAP financial measure is provided in the Reconciliation of Non-GAAP Adjusted EBITDA table included in this press release. An explanation of this measure and how it is calculated is also included under the heading “Non-GAAP Financial Measures.”

([2]) Includes $323 million non-cash goodwill impairment.

Investor Relations Contact:

Jeffrey Geyer

Cano Health, Inc.

(786) 206-1930

investors@canohealth.com

Media Relations Contact:

Georgi Morales Pipkin

Cano Health, Inc.

(786) 206-3322

mediarelations@canohealth.com

(1) De novo losses include those costs associated with the ramp up of new medical centers and losses incurred for the 12 months after the opening of a new facility. These costs collectively are higher than comparable expenses incurred once such a facility has been opened and is generating revenue, and would not have been incurred unless a new facility was being opened.

(2) Transaction costs included $2.7 million and $1.0 million for the three months ended December 31, 2022 and 2021, respectively, of corporate development payroll costs. Corporate development payroll costs include those expenses directly related to the additional staff needed to support our acquisition activity.